At the most basic level, copays are a cost-sharing measure that insurance companies implement as part of coverage plans. Typically, a copay is a fixed amount that's established based on the plan and the specific service. However, copays are only one part of a larger cost-sharing structure.

Want to skip the basics? Click to jump to Copays: How we got here.

The basics of cost sharing

Cost sharing comes in three primary forms: copays, coinsurance, and deductibles. Plans may be complex, but patients using health insurance need to pay special attention to these elements because they define what they’re required to pay when receiving medical care.

1. Copay

Copays are fixed fees insurance companies set as part of an insurance plan. They’re based on the services rendered, including office visits, prescription drugs, and other types of care. Because copays are fixed amounts, the insured person knows their financial obligation ahead of time, and they are required to pay it before receiving care.

2. Coinsurance

Coinsurance is an amount calculated as a percentage of the total cost for a covered medical service. If an insurance company owes a doctor $100 for a patient's visit, and the patient's plan has a coinsurance percentage of 25%, the insured patient will be required to pay $25 towards the cost of that visit.

3. Deductible

A deductible is a set dollar amount that the insured patient is required to pay before the insurance company begins paying their portion of claims. Typically, deductibles reset annually.

Copays: How we got here

The concept of cost-sharing as part of healthcare was originally designed by a group of providers and hospitals during the Great Depression. These conglomerations set not-for-profit subscription fees to ensure families and communities could continue to receive needed care.

Over time, as care extended within these communities, costs continued to rise. A push emerged for private plans that established their own cost-sharing measures.

On the surface, private plans sought to extend coverage, much like the subscription fees, but they placed more financial requirements on their members. Instead of covering the cost of care from the first dollar paid, private plans required the insured to pay copays and deductibles before their coverage kicked in.

On the surface, private plans sought to extend coverage, much like the subscription fees, but they placed more financial requirements on their members. Instead of covering the cost of care from the first dollar paid, private plans required the insured to pay copays and deductibles before their coverage kicked in.

Finances played a partial role in this strategy. Private plans are in the business of making money, so they have an incentive to keep their costs low and pass on as much of the expense as possible.

However, another reason for these copays and deductibles was to prevent members from seeking unnecessary care. If members had the perception that their healthcare was essentially free after their basic fees, they might be tempted to access services every time they sneezed. Insurers believed that, when members were required to share the burden of paying for care, they would be less likely to abuse their benefits.

Ryan Schmid, President & CEO and a co-founder of Vera Whole Health, goes more in-depth:

"There are two primary drivers for why we have copays. One is that it is simply a method for, usually the employer, to shift costs onto the employee. So it just saves the plan money — that's one.

But the bigger reason for copays is based on a consumerism concept that, if members have to pay for something, they're going to be better purchasers. If it's free, then there's potential they'll overuse it, won't value it as much, or they'll abuse it."

Copays, as well as other cost-sharing measures, may have been well-intentioned and designed to prevent a patient from seeking unnecessary acute care. However, the reality is that many cost-sharing requirements prevent access.

Copays can mean less access to care

As the cost of healthcare has continued to rise over the last several decades, cost-sharing measures like copays have also increased. What was originally intended to prevent patients from breaking the bank when they needed care is now preventing many from seeking care at all.

Insurance companies have a vested interest in delivering as little treatment as possible and passing on whatever costs they can. Ultimately, health insurance is a for-profit industry, and cost-sharing requirements create even more profit opportunities.

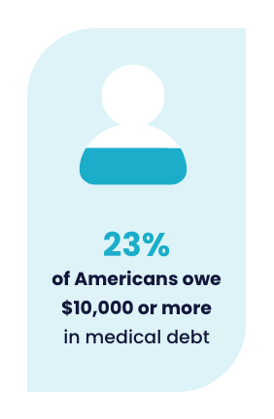

Those costs can add up for healthcare consumers. A recent report from the Commonwealth Fund revealed that, in 2020, insurance premiums and deductibles took up 11.6% of the average American’s income. A survey from Gallup and West Health discovered that 23% of Americans feel the cost of healthcare has become a major financial burden. And, a survey by Affordable Health Insurance found that a quarter of all Americans, including those with insurance, have medical debt of more than $10,000. Even copays, which might seem initially manageable, can add to this burden, causing people to skip primary care appointments and avoid purchasing necessary prescription drugs.

We believe the form of healthcare the industry needs, to both contain costs and make quality care accessible, is based upon an advanced primary care (APC) model. APC manages all care, including referrals to high-quality, low-cost specialists. This approach controls costs for employers, but it's also convenient and less costly for employees.

This approach also means no copays or other financial barriers for employees. They make an appointment, spend time with their primary provider, and get access to the support and care they need. It's that simple.

Editor's Note: This is an updated version of the original post published on July 16, 2019.