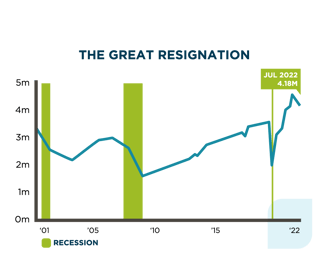

Turnover is a frequent and harsh reality for many companies. The pandemic and the Great Resignation initiated enormous shifts in workplaces across the country causing many organizations to face historic levels of turnover. The challenges show no sign of slowing.

Even as the number of workers quitting slows slightly from those historic highs, hiring and retention remains a huge priority for employers. According to the latest Job Openings and Labor Turnover Survey (JOLTS) report, in July 2022, 4.18 million Americans left their jobs and there were 11 million job openings recorded. This indicates that the “quitting economy” has yet to abate.

Even as the number of workers quitting slows slightly from those historic highs, hiring and retention remains a huge priority for employers. According to the latest Job Openings and Labor Turnover Survey (JOLTS) report, in July 2022, 4.18 million Americans left their jobs and there were 11 million job openings recorded. This indicates that the “quitting economy” has yet to abate.

In this unpredictable and changing environment, there’s an opportunity for employers to take action and for payers to play a role in improving retention rates and making employees feel valued.

Turnover comes at a high cost

Each time an employee leaves, it can be a significant setback to bottom lines. Depending on a variety of factors, including seniority and role, employee turnover can cost businesses 1.5 to 2 times the salary of each employee. There are additional setbacks that are harder to quantify, such as the impact on team morale when employees leave.

Employers can improve retention rates by offering a robust, accessible benefits program to employees, and payers are uniquely positioned to help. While perks such as catered lunches or special events lose their ability to attract and retain talent, benefits and wellness programs are more highly prized than ever.

Employers can improve retention rates by offering a robust, accessible benefits program to employees, and payers are uniquely positioned to help. While perks such as catered lunches or special events lose their ability to attract and retain talent, benefits and wellness programs are more highly prized than ever.

Member satisfaction is key to surviving the challenges brought about by the Great Resignation and the challenges that will follow. Happy, healthy employees are more likely to stay with a company—and employers who invest in rich benefits are more likely to increase productivity and revenue while containing costs.

Engaged members lead to higher rates of retention

Members who are engaged in their healthcare plans have higher retention rates. In a survey released by America’s Health Insurance Plan (AHIP), it was found that employer-provided health coverage was a key factor for 56% of employees when deciding whether to remain at their current jobs.

While measuring a member’s engagement isn’t always simple, attractive benefits such as free primary care and health coaching increase the likelihood they will take ownership of their personal health.

The City of Kirkland, in partnership with Vera Whole Health, developed an incentive program around an Annual Whole Health Evaluation. This evaluation includes an extended appointment with a primary care provider, a biometric screening, a health assessment, and an introduction to health coaching.

For completing an Annual Whole Health Evaluation, employees receive a $600 credit toward their Health Savings Accounts. While the monetary incentive is appealing, the overarching goal of the program is to introduce members to the breadth of whole health services they can expect from Vera Whole Health. Once they are invested and engaged, the rate of retention rises.

For completing an Annual Whole Health Evaluation, employees receive a $600 credit toward their Health Savings Accounts. While the monetary incentive is appealing, the overarching goal of the program is to introduce members to the breadth of whole health services they can expect from Vera Whole Health. Once they are invested and engaged, the rate of retention rises.

How APC impacts member engagement

According to Todd Katz, executive vice president, Group Benefits, at MetLife, “In the past, there was a clear delineation between work and life. That line is now blurred with work and life overlapping more than ever before. As this happens, employees are looking to their employers to help them with their overall wellness needs ... As employees have more non-traditional workplace options available to them, it will become increasingly important that employers prioritize holistic wellness to drive employee engagement and loyalty in this new era.”

Members truly care about their healthcare, and they want access to the kinds of features offered through the APC model. These include:

- Personalized care from providers who dedicate more time to their needs

- Care teams who listen to their concerns and treat them with empathy and understanding

- A holistic approach to healthcare dedicated to keeping them healthy and not simply treating symptoms after they occur

When members have access to APC treatment that delivers all these benefits, they’re far more likely to be engaged in the process and continue seeking routine care. Their overall health outcomes improve, their productivity is boosted, and their levels of satisfaction are high.

When members have access to APC treatment that delivers all these benefits, they’re far more likely to be engaged in the process and continue seeking routine care. Their overall health outcomes improve, their productivity is boosted, and their levels of satisfaction are high.

It’s undeniably advantageous to employers. Payers who are able to deliver this type of member experience also have a substantial impact on employee group plan retention. This translates into increased revenue, higher productivity, and a robust workplace culture capable of withstanding and overcoming challenges brought about by the pandemic, the Great Resignation, and an uncertain economic future.

.png?width=922&name=vera%20-%20employee%20turnover%20-%20cta%20(1).png)

Editor's Note: This is an updated version of a post originally published on December 21, 2021.