Benefits offerings are a key factor in attracting and retaining employees, while also keeping those employees physically and mentally healthy. As pressures from COVID-19 and a more limited job force drive the prioritization of impactful, cost-effective plans, there’s an opportunity for your benefits advisor to help you meet the emerging needs of your employees in 2023 and beyond.

Please note: I used the term “benefits advisors” for this post, however, at your organization, you might utilize a number of different titles, as they can change regionally or based on market segment.

A health plan that really helps

Existing benefits plans aren’t always capable of meeting challenges introduced by the ongoing COVID-19 pandemic, including:

- Overcoming high rates of turnover

- Implementing testing protocols

- Offering family medical leave options

- Supporting employees with behavioral challenges and health issues resulting from the COVID-19 pandemic

As an employer or HR professional, you need new solutions that work. When your benefits plan isn't capable of meeting emerging healthcare challenges, or assisting you in navigating those challenges, it leads to cascading problems, such as poor retention and worsening employee health outcomes.

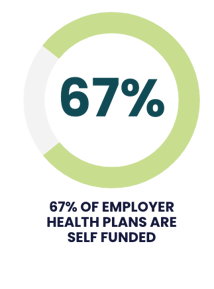

There’s also the case of rising costs. Nationally, 67% of employer health plans are self-funded, meaning that organizations are frequently paying higher costs and receiving lower quality.

There’s also the case of rising costs. Nationally, 67% of employer health plans are self-funded, meaning that organizations are frequently paying higher costs and receiving lower quality.

Even prior to the pandemic, larger organizations were identifying these problems and exploring progressive solutions, such as value-based healthcare and care transformation.

As you build out your benefits strategy, you are likely searching for options that will similarly remove variations in cost and quality. Perhaps you’ve relied upon, or considered relying upon, a benefits advisor to help you find new ways of building an impactful health plan.

Here’s how you can ensure a productive and meaningful partnership with your benefits advisor.

1. Understand the ways in which this dynamic is evolving

As the healthcare industry shifts and workplaces across the country face new challenges, the partnership between HR professionals and benefits advisors is also changing. While a productive partnership should be results-oriented and driven by data, in the past this didn’t always occur. Perhaps you’ve wondered whether your interests were truly aligned with those of your benefits advisor.

As the healthcare industry shifts and workplaces across the country face new challenges, the partnership between HR professionals and benefits advisors is also changing. While a productive partnership should be results-oriented and driven by data, in the past this didn’t always occur. Perhaps you’ve wondered whether your interests were truly aligned with those of your benefits advisor.

The good news is that there are promising changes on the horizon, changes which stand to benefit everyone involved. Staying abreast of this evolving dynamic will allow you to better control costs and prioritize employee health outcomes. As the industry shifts, you now can and should require that your benefits advisor give you access to data demonstrating whether or not your strategy is meeting your goals and also provide solutions for when you fall short of those goals.

2. Take advantage of increasing transparency

In the past, benefits advisors made money through arbitrage (the process of purchasing an asset in one market while selling it at a higher price in another market) on the cost of claims, meaning they got paid on higher claims. They also received compensation through premium-based commissions on cases and contingency compensation based on the volume and persistency of cases they put with a carrier.

This method of compensation can lead to a breakdown in trust. HR professionals couldn’t always be certain if their benefits advisors were focused on reducing costs and improving health outcomes when they were paid by adding services.

But, this is shifting. One reason is the new broker compensation disclosure rules that came out in 2021. These rules require that benefits advisors disclose all the compensation they receive on a group upfront, increasing transparency and creating a different quality of relationship between benefits advisors and purchasers in the marketplace.

3. Consider options that allow your benefits advisor to share your risk

Value-based healthcare and new approaches to claims risk within the healthcare industry are also altering the ways in which benefits advisors partner with HR professionals. Benefits advisors are now more likely to go at risk with their group, by identifying major health problems that most dramatically change the economics of a groups’ finances inside their plans. This means they’re financially invested in creating better health outcomes, reducing catastrophic risks, and more.

Value-based healthcare and new approaches to claims risk within the healthcare industry are also altering the ways in which benefits advisors partner with HR professionals. Benefits advisors are now more likely to go at risk with their group, by identifying major health problems that most dramatically change the economics of a groups’ finances inside their plans. This means they’re financially invested in creating better health outcomes, reducing catastrophic risks, and more.

It’s a huge shift and, when benefits advisors take more ownership in the end results of their work, it means your interests— and the interests of your employees — are now aligned.

4. To make a real difference, prioritize clarity

A productive relationship between HR professionals and their benefits advisors must be results-oriented and data-driven. Both parties need to meet a clear list of expectations.

This is an area in which assigned primary care can make a genuine difference. When primary care becomes a priority, driving care through the entire population, it addresses the fragmentation and volume that’s rampant in fee-for-service models. Accountability also increases when employees have assigned primary care physicians.

Education truly is key. More and more, benefits advisors are getting involved on a more intimate level, boosting engagement and improving outcomes for employees. Has your benefits advisor educated themself regionally on variations in cost and quality in health systems? Do they understand the supply chain?

Ask questions to discover if your benefits advisor understands the market makers for your region. Are they informed on value-based approaches and actively exploring approaches other than legacy, fee-for-service models? If so, they can offer greater value than ever before, helping you pinpoint more affordable models with superior, patient-reported outcomes.

5. Consider an advanced primary care (APC) model

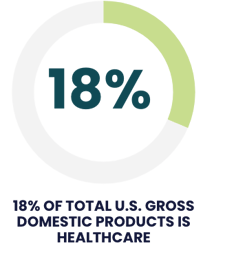

Healthcare in the U.S. now takes up nearly 18% of our gross domestic product. And, for a long time, healthcare spending has been an opaque area.

Healthcare in the U.S. now takes up nearly 18% of our gross domestic product. And, for a long time, healthcare spending has been an opaque area.

The COVID-19 pandemic strained the system and revealed its shortcomings. Many specialists and primary care providers didn’t have the technological infrastructure needed to provide patients with access to definitive care, including polychronic patients and those with high blood pressure or hyperlipidemia. Even people with cancer and other major health issues weren’t able to access definitive care. People using telehealth services to receive medical care weren’t always speaking to someone with access to their medical records and health history.

HR professionals and benefits advisors need to honestly evaluate the shortcomings of this dynamic and realize it is time for new solutions.

In order to be truly relevant to the needs of employees, a tech-enabled APC model is a necessity. This means the model is willing and capable of bearing risk, supporting each patient and their journey, integrating each practice unit with behavioral resources, pharmacies, and health coaching. Providers need to be able to meet with their patients in person and virtually, while also coordinating specialist care. There must be preventative care, consistency, and strategies for patient engagement.

It’s a confusing time to put together a benefits plan and the APC model has solved many of the issues that caused employees to feel afraid or abandoned during the pandemic. Because of this, investment in APC is growing. It creates accountability and offers access to definitive care while controlling costs and improving health outcomes by placing patients at the center of the equation.

An option where everyone wins

HR professionals and benefits advisors need to come together to resolve variation, reduce total cost of care, improve quality, and solve employer’s primary problems. Continuing with old approaches will not improve results, and hoping for something better is not a strategy at all. APC creates superior, predictable outcomes for employers and employees. Placing APC at the center of a benefits plan is the best way to start.

Jeffrey Hogan is the President of Upside Health Advisors and a national expert on healthcare, including benefits planning, value-based healthcare, and payment reform.

Want to know more? Learn how Advanced Primary Care reduces the total cost of care and improves health outcomes.